workers comp taxes for employers

Well review your current workforce and recommend best options for coverage. This means that 200 of your workers compensation benefits could be subjected to taxation.

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

Here are some workers comp facts that everyone should know.

. In order to bring down the combined benefits to 80 of 2000 or 2500 your SSDI would have to be reduced by 200. The IRS manual reads. However retirement plan benefits are taxable if either of these apply.

Take caution not to directly supervise 1099 workers as that could qualify them as an employee. 1025 for lunch and 2425 for dinner. Common expenses include travel office equipment and supplies and phone and internet services.

If youve received workers comp over the previous tax year you might be wondering whether youll owe taxes on them. You then multiply that number by the premium rate for the class code to find the total cost of. 2 days agoThe general answer is no.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel. Compensating remote workers for business expenses. The cost of up to 50000 of life insurance provided to employees isnt included in their income.

In that sense workers comp is in the same. Multiply 2000 by 145 to determine how much you will pay. But if you return to work any wages you do receive are taxable even if youre on light duty.

Whether you pay Ohio BWC KEMI or popular private carriers like Travelers or Liberty Mutual one thing that is common across the board for work comp insurance is that your insurance premium looks more like a payroll tax then an insurance bill. Lets say your Average Weekly Wage AWW prior to your workplace injury was 100 and your wages while on light duty were only 50. The amount paid should equal 80 of an employees after-tax average weekly wage including overtime and discontinued fringe benefits.

16 hours agoIt is the responsibility of employers to maintain Workers Compensation insurance for the benefit of injured employees according to Arkansas Code 11-9-401. The following payments are not taxable. Michigan employers have saved hundreds of millions of dollars over the last decade in workers comp costs.

Workers comp benefit payments were designed to cover your lost wages. Also under California Labor Code Section 132a workers compensation benefits may incur a tax obligation if it resulted from an act. By law you can only receive up to 80 of your pre-injury earnings between SSDI and workers comp benefits.

Call Us Today For A Free Consultation. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Educational assistance benefits under 5250 paid to employees in a.

Workers compensation benefits are payable to individuals who have suffered a work-related injury or illness. The standard FUTA tax rate is 6 so your max contribution per employee could be 420. Benefits provided to the employees of California by the states workers compensation insurance program are not taxable.

But life insurance costs paid by your company of over 50000 are taxable to employees. The fee for the employer is 230 times the number of covered employees working on the last day of the quarter. Workers compensation settlements and weekly payments are not subject to income taxes.

According to the federal tax code detailed by the IRS incidental insurance. Ad Involved In A Workplace Accident. Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable income.

8810 is 016 and well round their salary to 20000. Your employer liability is 29 and withhold 29 from employee wages for their portion. Well Fight For The Compensation You Deserve.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. Since workers compensation benefits are not taxable the Internal Revenue Service does not allow taxpayers to deduct their awards. Dealing with a work injury can be stressful not only because youre hurt but dealing with your employer and the.

When implementing work-from-home policies employers should consider the tax aspects of paying or reimbursing business expenses for remote workers. Over 100 Million Won For Our Clients. Each employers premium is based on rates for different job categories that are multiplied by.

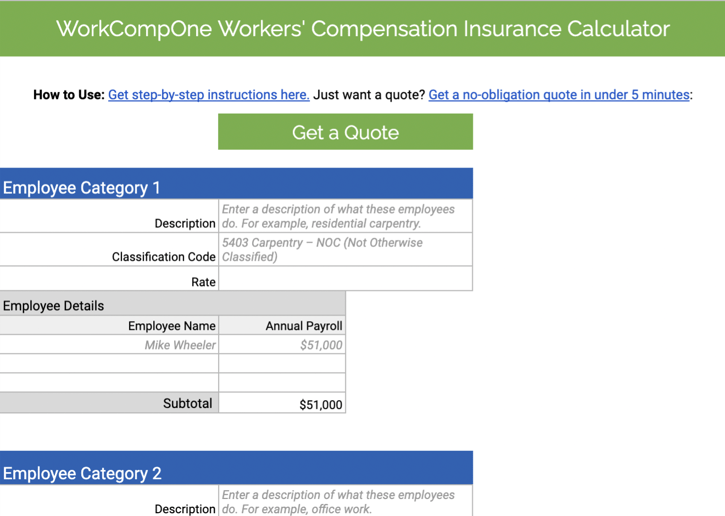

A 20000 payroll with a workers compensation rate of 016 would cost just 32 per year. The maximum weekly comp rate for 2022 is 104800 per week. However business owners can deduct their workers compensation taxes or payments to cover insurance premiums.

Checks are paid on a weekly basis and. When an employee suffers an illness or injury on the job it is the responsibility of the employer to provide workers compensation a public federally funded benefit that assists the employee. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

Since 50 is less than 80 of your AWW you. Yes workers comp payments and benefits that employers pay to their employees are deductible business expenses. Once you have the estimated annual payroll for the employee divide that number by 100.

Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law. Payment is due by the last day of the month following the end of the quarter. The employer must obtain a workers compensation insurance policy.

However you can also claim a tax credit of up to 54 a max of 378. Business owners are able to deduct the costs of required insurance payments from their tax liability if they are necessary for their business operations. This cost is included in Box 1 and in Box 12 of the W-2 as one of the options.

The quick answer is that generally workers compensation benefits are not taxable. If you also receive SSDI with your workers compensation youll pay taxes on the SSDI like usual. You dont have to pay taxes on weekly checks under workers comp.

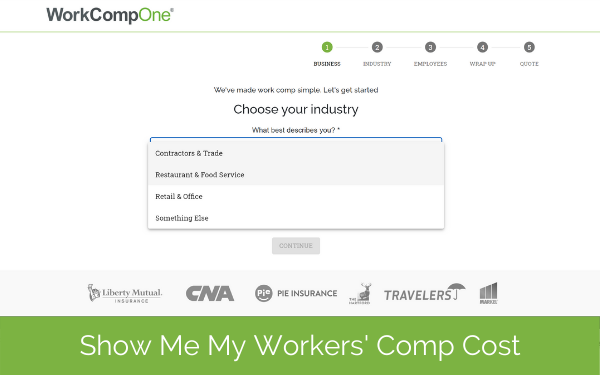

Say an employees biweekly gross pay is 2000 again. Start your workmans compensation insurance quote online or give us a call today at 888-611-7467. Once you come to the end of your year policy your final workers comp rate can be adjusted to account for initial over- or under-estimated payroll projections.

It doesnt matter if your settlement is in a lump sum or structured to pay benefits over a period of time. Read on for the answer. The fee for covered employees working on the last day of the quarter is 200.

Thus while a portion of your workers comp may considered taxable income in practice the taxes paid on workers comp are usually small or non-existent. Employers always pay 145 of an employees wages. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

The clerical workers rate NCCI code. Then multiply it by the class code rate of 144. Employers can typically claim the full.

Reimbursement for lodging is 8500 plus taxes. Do you claim workers comp on taxes the answer is no. This is based upon the highest 39 paid weeks out of the last 52 before the workplace accident occurred.

This leaves you with a total estimated payroll of 2016 or 1008 per employee. We want to be your workers compensation agency.

How To Calculate Workers Compensation Cost Per Employee

Is Workers Comp Taxable Workers Comp Taxes

Workers Compensation And Taxes James Scott Farrin

Costratesadvisor Com Payroll Analysis Report Workers Comp Insurance Analysis Payroll Taxes

The Workers Compensation Notice Employers Resource

Fmla Vs Workers Compensation Rules What No One Tells You

Ncci State Map State Map Small Business Insurance Map

Is My Workers Comp Taxable Ksa Insurance

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

What Wages Are Subject To Workers Comp Hourly Inc

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

When Does Workers Comp Start Paying After A Workplace Injury

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

Permanent Disability Pay In California Workers Comp Cases 2022

Workers Comp Is Never Off The Clock

Workers Compensation Insurance Overview Amtrust Financial

Texas Workers Compensation Laws Costs Providers

Ohio Workers Compensation Benefits And Income Tax Monast Law Office